Articles

While each bank’s mobile banking app will get perform in a different way, the process essentially pursue an identical steps. Some banks might not accommodate mobile dumps for the particular issues, including international checks, very be sure to comment their bank’s principles ahead of time. Cellular view dumps has turned financial management by providing somebody and you will enterprises to deposit checks conveniently as opposed to checking out a bank branch.

Casino Bell Fruit login: What exactly is Mobile Take a look at Deposit and you may just what profile are eligible?

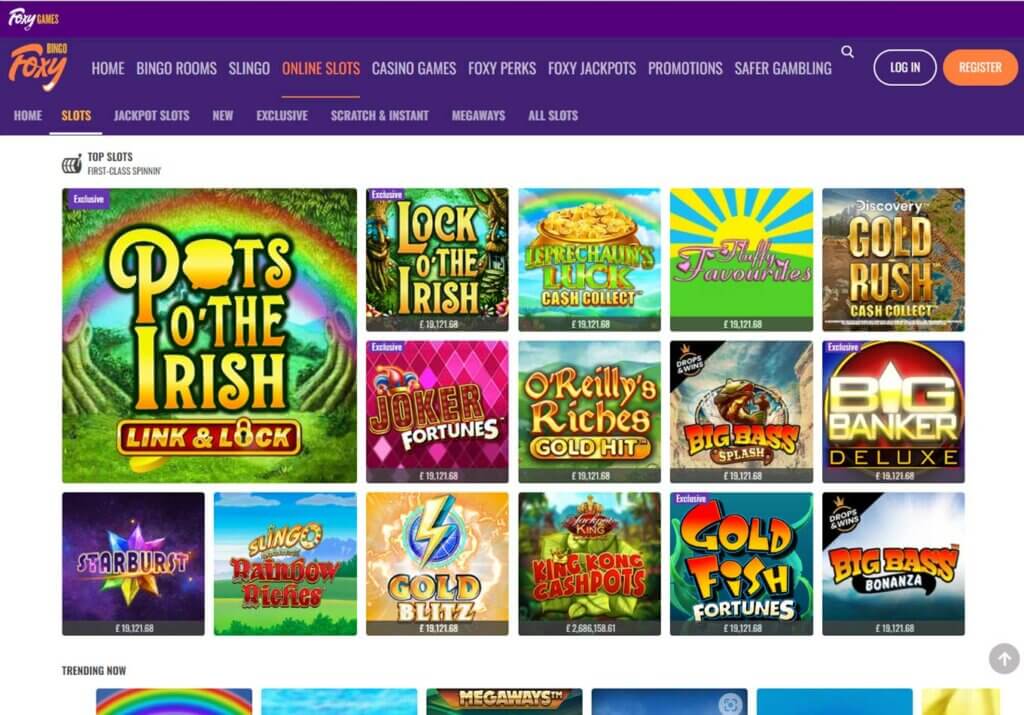

Next, get the Spend From the casino Bell Fruit login Mobile approach you want to play with (then it Boku otherwise Siru, for example). At the NewCasinos, we have been totally clear in the manner i finance all of our site. We would earn a payment for many who simply click certainly all of our companion website links making in initial deposit at the no additional prices for you. Our member partnerships don’t determine our reviews; i remain impartial and you may honest within our advice and you can ratings very you could play responsibly and you can well-informed.

CNBC See demonstrates to you how mobile view placing functions and lots of factors you will want to bear in mind.

Of numerous financial institutions make it ranging from $step one,100 and you will $10,100 within the cellular deposits daily, although some may offer high or all the way down restrictions. Look at the bank’s mobile put policy to understand the exact restrict. Mobile places tend to obvious in this a couple working days, they cut down on too many trips, and so they include a supplementary level from protection as a result of encoded tech. The new app uses security to guard your data and maintain your own put safer. Most banking companies make it cellular places private checks, team checks, cashier’s checks, and authorities checks.

Take a look at eligibility

Discover answers to issues about precisely how cellular consider deposit work, as well as how to use it, what forms of inspections you might put, and you may what to do that have a check after you deposit it. Lower than, i listing the brand new prepaid notes having cellular places, bought starting with the best total possibilities. You could shred otherwise disposable a check once you put they during your smartphone, however is always to hold onto they for a few months after. Sometimes it might look such as the look at have a tendency to clear great however, for those who have any points, it’s best to feel the unique document useful in case you need is actually once more. There isn’t any solitary mobile bank that is the perfect for all condition. For example, some people might find Chime’s $2 hundred percentage-100 percent free overdraft very useful while some tend to favor Friend Lender’s wider assortment from economic functions.

This is the same as promoting a magazine be sure your deposit from the a department or thru an atm. On the back of your view the lower the signature, you’ll need generate the words “to possess cellular put only” or certain adaptation, according to your own financial or borrowing relationship’s requirements. Without one, your financial institution could possibly get will not prize the newest cellular consider deposit plus the money claimed’t end up being credited for you personally. Come across Chase.com/QuickDeposit or perhaps the Pursue Mobile application to own qualified cell phones, restrictions, conditions, conditions and you can info. Financial institutions have mobile put limitations positioned to protect against scam and ensure the protection of its customers’ money. By the setting a limit on the cellular deposits, financial institutions decrease the possibility of large deceptive purchases are canned from cellular deposit element.

Trick Lender just allows you to deposit around $ten,100 together with your portable. Cellular financial is quite useful for some people, however, you’ll find drawbacks you should imagine ahead of opening an enthusiastic membership. Do you enjoy getting in touch with a neighborhood, Florida banker to talk about your individual economic needs? Cellular consider deposit is regarded as secure due to actions such security.

Armed forces pictures are used for representational aim only; do not suggest regulators approval. Depending on the type of account you’ve got, your financial organization may charge a fee in order to deposit cheques digitally. Pose a question to your standard bank when funds from a mobile cheque deposit might possibly be available. Money requests, lender drafts, certified cheques and you may site visitors cheques can be qualified to receive digital put. Look out for qualifications, keep episodes and you may costs as they can vary of within the-department banking. Follow the tips in your banking software in order to put their cheque.

After that improvements in the economic tech and you can increasing use prices are most likely to switch user experience and you may defense. MyBankTracker features married having CardRatings for the visibility out of mastercard points. MyBankTracker and CardRatings could possibly get discovered a percentage from card issuers. Opinions, ratings, analyses & guidance would be the creator’s by yourself, and also have maybe not become assessed, supported otherwise approved by these organizations. MyBankTracker creates funds as a result of the dating with the couples and you may associates. We could possibly mention otherwise are reviews of its things, at times, but it does maybe not affect the suggestions, that are totally in accordance with the lookup and you may work your editorial team.